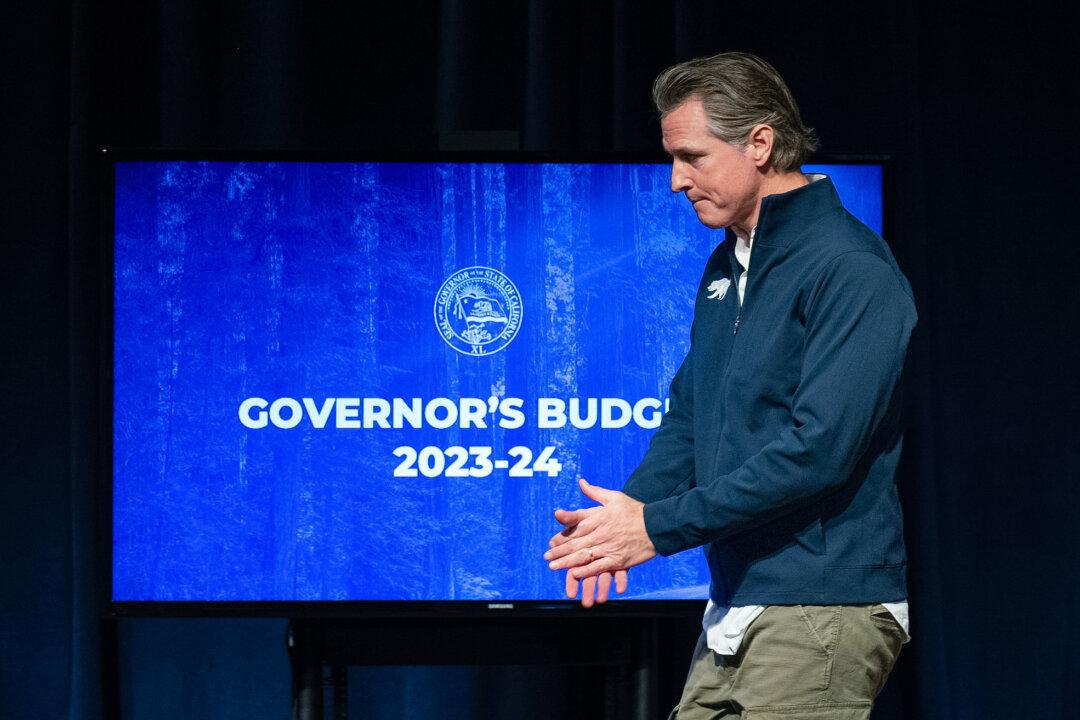

With California facing a record budget deficit, many are looking to Gov. Gavin Newsom’s release of his revised upcoming budget scheduled for May 10 to offer clarity and solutions.

Questions soon to be answered in what is known as the “May Revise” include what spending cuts will be on the table, whether the governor will seek to raise revenues by increasing taxes or calling for bonds, how lawmakers will respond to his updated proposal, and how severe the deficit truly is.

Though uncertainty has persisted for months, the revision should offer more insight into the state’s finances and will potentially unveil some of the “tough choices” lawmakers from both sides of the aisle have repeatedly spoken about regarding balancing the state’s finances.

Determining the depth of the deficit has proven difficult, as the governor estimated the shortfall at $38 billion with his January budget proposal, while the non-partisan Legislative Analyst’s Office calculated in February a $73 billion gap in spending and revenues.

Some of the discrepancies are related to Mr. Newsom’s initial proposal, which experts said included $58 billion in potential solutions, analyst Gabriel Petek told The Epoch Times. But with tax payments due April 15, analysts and economists now say the deficit could be widening.

Revenues ultimately failed to meet expectations by more than $6.5 billion, according to the state’s finance department, led by forecast misses for personal income, corporate, and sales taxes.

Corporate taxes fell short of the governor’s estimates by about $2 billion—a 15 percent drop from last year—the fourth largest such decline in 40 years, according to analysts.

“Recent shortfalls in corporation and sales tax collections reflect an underlying weakness in these revenue sources,” the analyst’s office said in a May 2 report.

While income taxes increased year-over-year, they failed to meet projections and remain below peaks from the 2021-22 fiscal year.

Analysts pointed in the same report to significant “economic headwinds,” including “a steady rise in the state’s unemployment rate, a continued dearth of investments in California business, and inflationary pressures” as contributing to weakness in revenue collections.

Such barriers are buoyed by one of the fastest stock market rallies in history between October 2023 and March of this year, as stocks spiked 20 percent, analysts said.

Noting the rally was one of California’s “few bright points,” experts warned that barring better economic conditions outside of the stock market, tax revenues could fail to meet future expectations.

“Unlike other stock market rallies, however, the recent run-up has not occurred alongside broader improvements in the state’s economy that would further boost income tax revenues,” the analyst’s office said May 2. “Without such broader improvements, income tax collections are unlikely to continue to grow at the current rate into the budget year.”

The deficit presented by the governor Friday could be lower than analysts’ estimates because he will deduct solutions recently introduced by the Legislature, according to a May statement emailed to The Epoch Times from H.D. Palmer of the state’s Department of Finance.

Democratic lawmakers introduced Assembly Bill 106—known as a so-called “budget bill junior”— which was signed into law last month to address $17.3 billion of the deficit with reductions, deferrals, delays, and borrowing.

The bill revised past budgets from the prior two fiscal years to make up some of the difference by returning unspent money to the state’s general fund.

Critics called the solutions provided by the measure “accounting tricks” and “gimmicks” and suggested that more cuts and reduced spending are needed to sustainably balance the budget.

Some took exception to a tactic of delaying payroll costs from June 30, 2025, to the following day, thus pushing about $800 million onto the next fiscal year’s budget—a ploy first used by former Gov. Arnold Schwarzenegger and called a “gimmick” by Mr. Newsom when he first took office. At the time, he laughingly acknowledged that such could be used again if needed.

Additionally, $13 billion from the state’s reserve fund will be used to cover the shortfall.

Some critical of using reserves suggested, instead, to raise such by increasing taxes and removing some tax credits for certain high-earning corporations.

“Failure to implement meaningful revenue-raising measures leaves policymakers with increasingly difficult decisions and jeopardizes the progress in expanding vital support and investments throughout the state,” Mauricio Torres Jr., representing the California Budget and Policy Center, wrote on the nonpartisan research and analysis nonprofits’ website May 6.

The group also opposed cuts to supportive service programs aimed at low-income Californians.

“We urge policymakers to refrain from reducing support for programs and services that are critical for the well-being of California’s families, including food assistance, cash support, housing and homelessness supports, and other direct benefits,” Mr. Torres said. “Cuts in these areas would disproportionately impact low-income communities and Californians of color.”

Billions of dollars in cuts already proposed by the governor in January include those to affordable housing, climate related objectives, school facilities programs, student housing, and higher education, among other things.

“We’re going to make some adjustments,” Mr. Newsom said at the time. “We’re going to pull some money back.”