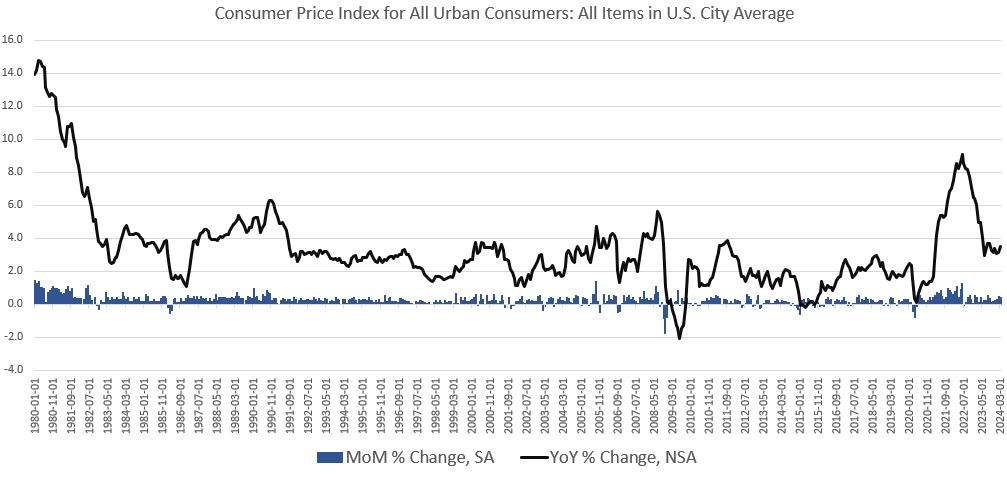

According to the BLS, Consumer Price Index (CPI) inflation rose 3.5 percent year over year during March, without seasonal adjustment. That’s the thirty-seventh month in a row of inflation well above the Fed’s arbitrary 2 percent inflation target.

Month-over-month inflation was flat with the CPI rising by 0.4 percent from February to March, with seasonal adjustment. Month-to-month growth had also been 0.4 percent from January to February.

The ongoing price increases largely reflect growth in prices for food, services, electricity, and shelter.

For example, prices for “food away from home” were up 4.2 percent in March over the previous year. Gasoline prices rose 1.3 percent over the period, but electricity surged to 5.0 percent. Prices for “services less energy services” rose 5.4 percent, year over year, while shelter rose 5.7 percent over the period.

Some specific categories were well above even this in year-over-year price inflation. For example:

1. Car insurance prices: up 22.2 percent

2. Car repair prices: up 11.6 percent

3. Transportation prices: up 10.7 percent

4. Hospital services prices: up 7.5 percent

5. Homeowners’ prices (“Owners’ equivalent rent”): up 5.9 percent

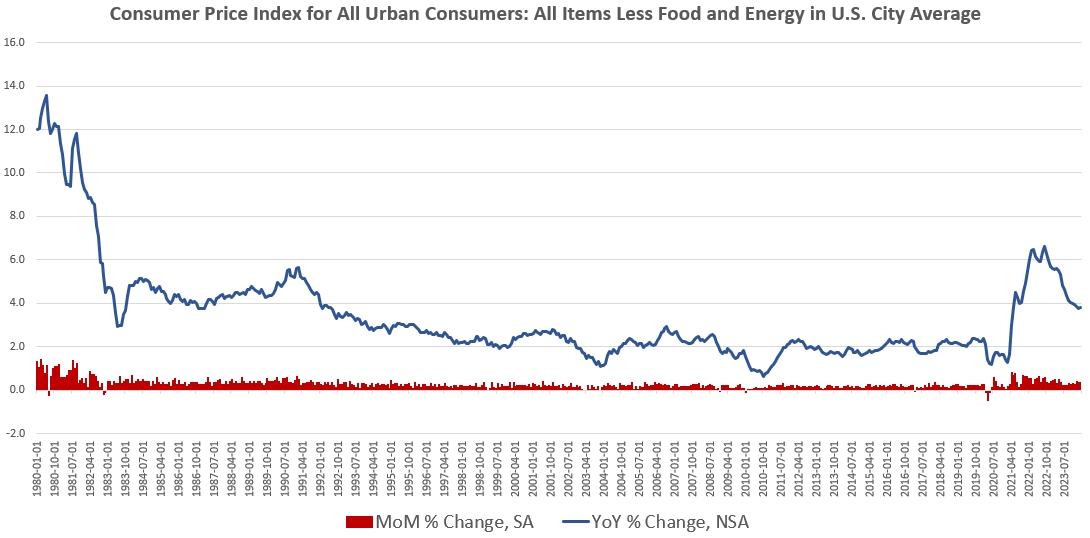

Removing volatile energy and food prices from the index, we find price inflation nonetheless remains stubbornly high. So-called core CPI growth remains almost double the “two-percent target”—at 3.8 percent—keeping price inflation growth near thirty-year highs. In other words, core CPI is a long way from returning to “normal.” Moreover, March’s month-over-month increase remains at 0.4 percent, which is the largest increase recorded in any month since April 2023.

Biden Blames Corporate Greed

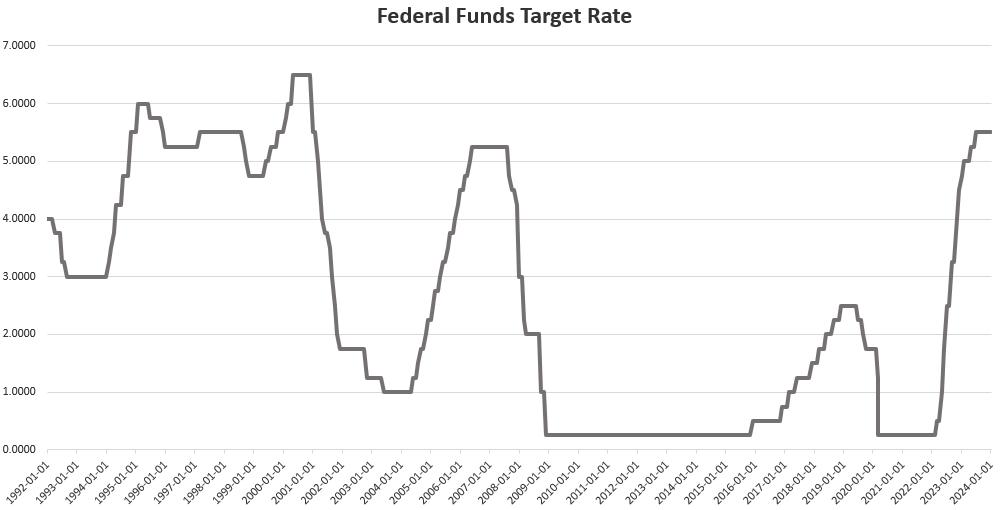

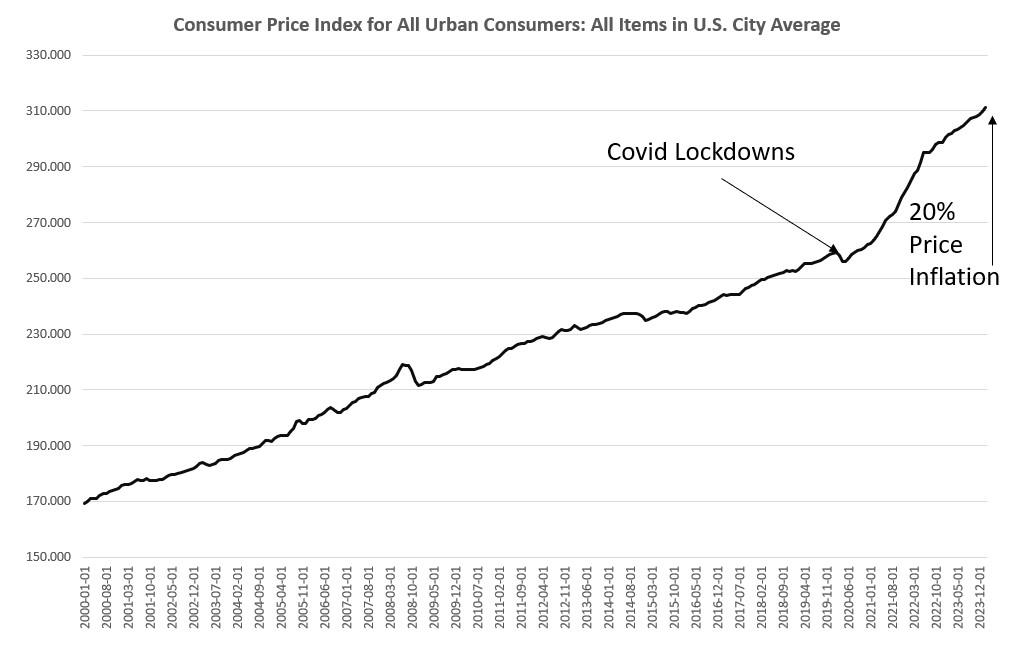

In recent months, supporters of the current regime have repeatedly claimed that inflation is “falling” or otherwise rapidly disappearing. Paul Krugman has been one of the most vocal cheerleaders claiming the problem of price inflation is “solved.” This morning, before the release of the new report, South Carolina Congressman Jim Clyburn insisted that price inflation in going down, and that people only believe prices are rising because of online “disinformation.”Moreover, for most of the first year of his presidency, Mr. Biden claimed there was no price inflation of any significance and joined Federal Reserve chairman Jerome Powell in claiming that price inflation was “transitory” and nothing to worry about. It was not until the summer of 2022 that the administration and the central bank admitted that surging price inflation required a response of some kind. Even then, the target policy interest rate was not allowed to rise above three percent until September 2022.

In other words, the response of this administration and its allies in the central bank actively continued to embrace inflationary easy-money policies well into the Biden years.

None of these things cause price inflation, of course. The cause of price inflation is monetary inflation fueled by the central bank.

In spite of all of this, the regime remains unrepentant, and there is little danger that it will admit its role in fueling the price inflation that is now crippling many ordinary Americans. Rather, we can expect the administration and the regime in general to continue gaslighting the public and claiming that greedy capitalists cause inflation.